Situation

The largest merger integration ever attempted in the World. This included merging all aspects of its global business, IT and operations. At the start of the Merger the client had a traditional Risk Management system that contained approximately 20,000 issues globally. There was little or no focus – their key question was ‘how can we avoid the budget of the integration programme spinning out of control?’

Approach

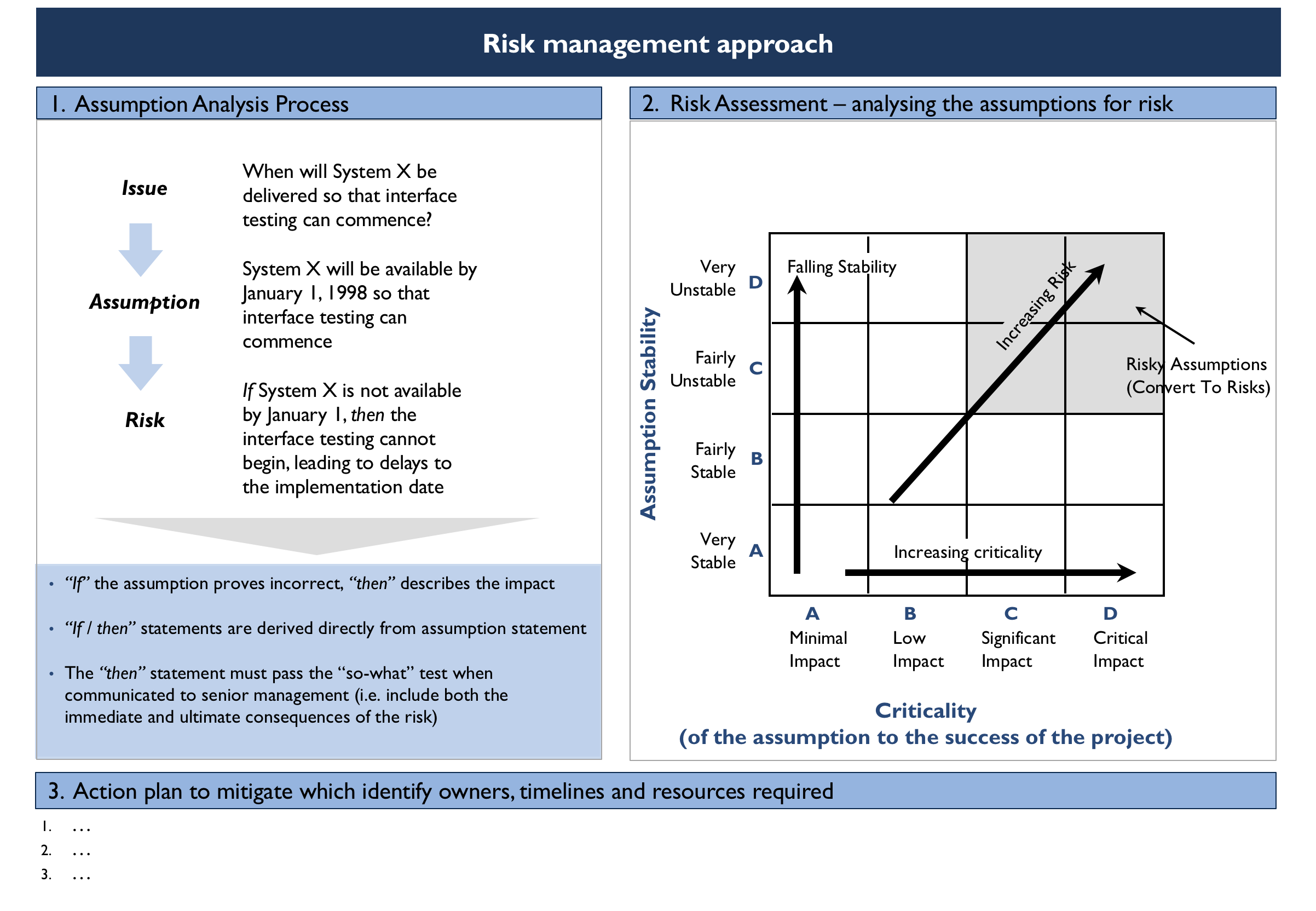

A team was established to capture and analyse the key assumptions across all significant merger projects. To do this we use our bespoke methodology, a fully scalable approach to de-risking or client’s organisation which focuses on positive assumptions, and measures their inherent risk.

Our approach was scalable for all aspects of their risk management from programme through to enterprise change:

- Programme – the individual risks preventing a project/programme not achieving its objectives and within plan

- Operational – identifying where the end to end supply chains and business processes are critical and inefficient.

- Enterprise – providing an holistic overview of the key risks to the business

From these, 50 “showstoppers” identified provided the initial focus and regular global reviews focussed on managing the risk until it was mitigated (moved from red/amber to green).

Results

The client has publicly acknowledged that the approach was a major factor in ensuring that the merger was a success. The Wall Street Journal described it as the “text book merger